Intel’s $8B CHIPS Grant Comes With a Catch—Government Ownership

Just when you thought 2025 couldn’t get any weirder, along comes Commerce Secretary Howard Lutnick with what might be the most audacious government intervention since… well, since the last time the government decided to play venture capitalist!

The big news? The Trump administration is seriously considering taking equity stakes in major chipmakers—starting with a juicy 10% slice of Intel—in exchange for those sweet, sweet CHIPS Act grants. And honestly? The reactions have been absolutely chef’s kiss levels of dramatic!

What’s All This CHIPS Act Hullabaloo About?

Let’s back up for a hot minute here. The CHIPS Act (Creating Helpful Incentives to Produce Semiconductors, for those keeping score at home) was supposed to be America’s big “we’re bringing manufacturing back, baby!” moment. Congress threw $52.7 billion at the problem, hoping to convince companies like Intel, TSMC, and Samsung to build their fancy chip factories right here in the good ol’ USA.

The original plan? Simple grants. Here’s some money, go build stuff, make America competitive again in the semiconductor game. Pretty straightforward, right?

Wrong!

Enter Howard Lutnick, stage left, with what he’s calling a “creative idea that has never been done before.” Translation: “Hey, why don’t we own a piece of these companies instead of just throwing taxpayer money at them and hoping for the best?”

Intel Equity: The Government’s New Side Hustle

Here’s where things get spicy! Intel equity is suddenly the hottest topic in Washington, and for good reason. The chip giant has been struggling harder than a college student trying to explain why they need more financial aid. Management blunders, technological setbacks, fierce competition—Intel’s been having what you might generously call a “rough patch.”

So when SoftBank swooped in with a $2 billion investment just days before Lutnick’s announcement, it probably felt like divine intervention. But now the government wants in on the action, too!

“We’ll get equity in return for that… instead of just giving grants away,” Lutnick explained on CNBC, probably while doing his best impression of a savvy investor who definitely knows what he’s doing.

The proposed deal? A non-voting 10% stake in Intel. Because nothing says “we trust your business decisions” quite like “we want to own part of your company but promise not to tell you how to run it.”

The Bigger Picture: Uncle Sam, Venture Capitalist Extraordinaire

But wait, there’s more! This Intel thing isn’t happening in a vacuum. Oh no, the Trump administration has been on quite the corporate ownership spree lately:

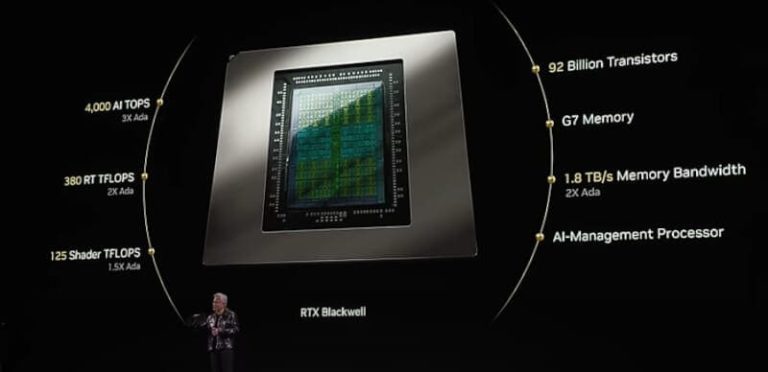

- 15% cut of Nvidia’s H20 chip sales to China (because why not take a slice of that AI gold rush?)

- Equity stakes in mining companies for rare earth magnets

- Shares in U.S. Steel as part of that whole Nippon Steel merger drama

It’s like the government looked at traditional economic policy and said, “You know what this needs? More direct financial involvement in private companies!”

Peter Harrell from the Carnegie Endowment (and former Biden White House economic advisor, so he’s seen some things) put it perfectly: this is “very different from what we have seen in the U.S. over at least the sort of 80 years since the end of World War II.”

The International Freak-Out Is Real

Want to know how unprecedented this is? Just look at how other countries are reacting!

South Korea’s basically having a diplomatic panic attack. Their presidential advisor, Kim Yong-beom, admitted they haven’t heard anything about equity requirements for Samsung’s U.S. investments. A Korean chip industry official dropped this bombshell: companies might just “decide not to invest or delay investments” if the U.S. keeps demanding ownership stakes.

Over in Taiwan, Economy Minister Kuo Jyh-huei was diplomatically scrambling, promising to “discuss with the National Development Council” about potential TSMC implications. Translation: “We need to figure out what the heck is happening before we commit to anything!”

Why This CHIPS Act Pivot Matters (Spoiler: It’s Huge)

Here’s the thing that’s got everyone’s knickers in a twist—this fundamentally changes the game! The original CHIPS Act was designed as an incentive program: “Hey, want some money to build factories in America? Here you go, no strings attached (well, minimal strings).”

Now it’s becoming more like: “Want our money? Cool, we’re also your business partner now. Hope you’re okay with that!”

The legal questions alone are mind-boggling. Congress authorized grants, not equity investments. Where’s the legal authority for this coming from? Lutnick and company better have some seriously good lawyers, because this is uncharted constitutional territory!

The Taxpayer Angle Nobody’s Talking About

Let’s talk about who’s really going to be affected—us, the taxpayers! Lutnick keeps talking about getting a “return on investment” for the American people, which sounds great in theory. But here’s the million-dollar question: what happens when these investments go south?

Remember, Intel isn’t exactly crushing it right now. Their stock has been on more roller coasters than a Six Flags enthusiast. If the government owns 10% of Intel and the company continues struggling, guess who’s potentially on the hook for those losses? (Hint: it rhymes with “shmaxayers”)

The Bipartisan Support Question Mark

Here’s what’s really wild—there actually was bipartisan support for the CHIPS Act! Republicans and Democrats agreed that America needed to step up its semiconductor game. But taking equity stakes? That’s a whole different conversation that nobody signed up for.

As Harrell pointed out, if the government had originally said “we want ownership stakes,” these companies probably would have just said “thanks, but we’ll stick to manufacturing in Taiwan and Singapore.”

Now we’re potentially changing the rules mid-game, which has got to be giving international investors some serious pause.

What’s Next for the Intel Equity Experiment?

So where does this leave us? Well, Intel’s executives are probably having some very interesting board meetings right about now. Do they take the government money with the new equity strings attached? Do they try to go it alone? Do they wait to see if this whole thing blows over?

The CHIPS Act was supposed to be America’s answer to global semiconductor competition. Instead, it might be turning into the world’s most expensive government venture capital experiment.

And honestly? Whether you love it or hate it, you’ve got to admit—it’s definitely not boring!

The next few months are going to be absolutely crucial. Will other chipmakers accept equity deals? Will the legal challenges hold up in court? Will taxpayers actually see returns on these investments, or are we about to learn some very expensive lessons about government ownership of private companies?

One thing’s for sure: the Intel equity experiment is going to be one heck of a case study for future economics textbooks!